TAILOR-MADE INVESTMENT SOLUTION FOR PENSION FUNDS

IST3 INFRASTRUCTURE GLOBAL (IST3 IG) was launched in 2014 as an investment strategy of like-minded Swiss pension funds with the aim of investing jointly in infrastructure. Our flagship in the field of infrastructure investments thus illustrates IST‘s philosophy: the provision of a high-quality investment solution by pension funds for pension funds, characterized by a high degree of transparency, cost efficiency and investor influence. The investment group falls under the category „infrastructure investments“ of BVV2 and aims for a target volume of CHF 1.5 billion.

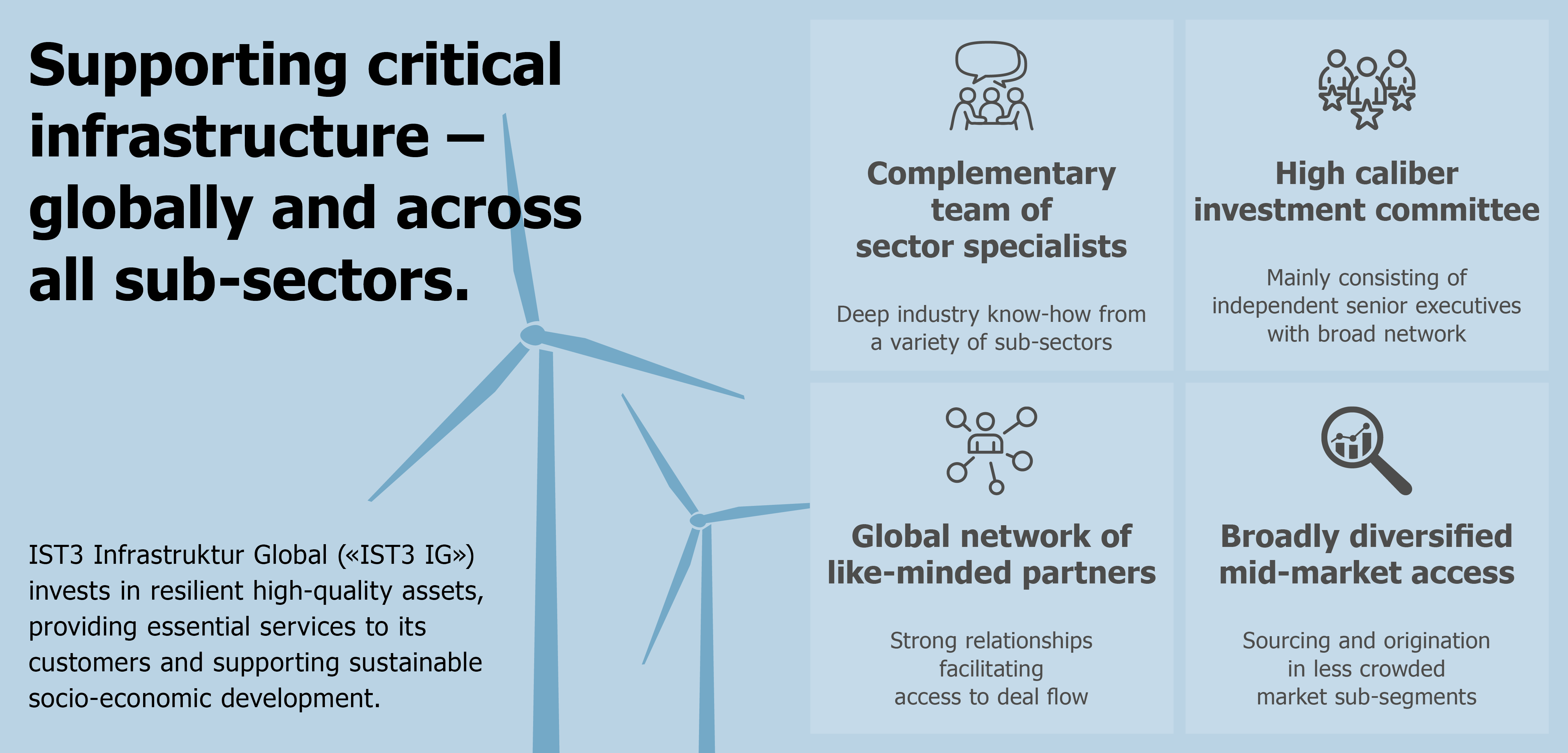

INVESTMENT STRATEGY WITH LOW RISK

IST3 IG‘s open-ended investment horizon (evergreen structure) favors a long-term buy-and-manage approach. The investment group invests globally diversified in infrastructure investments in OECD member states. The focus is on contractual and regulated cash flows, recurring dividend income (cash yields), low volatility, some inflation protection of returns and low correlation to economic cycles. Implementation takes the form of direct investments, co-investments and secondaries.

DEDICATED AND EXPERIENCED TEAM

IST3 IG is internally managed by a complementary team of investment professionals. Our transaction and asset management specialists, with subject matter experts in finance and engineering, have many years of experience in the infrastructure sector. Since the launch of the investment group, the team has been expanded in a targeted and sustainable manner. If necessary, external legal and tax experts are consulted for advice.

INDEPENDENT INVESTMENT COMMITTEE

The responsible Investment Committee consists mainly of independent specialists and executives. With their extensive network in the infrastructure industry and in the financial sector as well as their specific knowledge of the individual infrastructure sectors, they significantly support the origination activities of IST3 IG.

ADDING VALUE BY INCORPORATING ESG FACTORS

Infrastructure assets can create positive ESG effects through the delivery of important environmental, systemic and socio-economic services. As an investment group, IST3 IG supports the implementation of the United Nations Sustainable Development Goals (UN SDGs), which include using sustainable energy sources, promoting energy efficiency, education and science, responsible business ethics, and ensuring health and safety. This is most targeted for SDG 13 (climate action), SDG 11 (sustainable cities and communities), and SDG 7 (clean energy). Investments in the military, nuclear power, prisons, coal, and energy production from oil are fundamentally excluded.

INVESTMENT EXAMPLE: ALBERTA POWER LINE

This 508 km high-voltage transmission line in Alberta, Canada, is based on a 35-year contract with the AA-rated Alberta Electric System Operator (AESO). This landmark project have won multiple awards in terms of cost efficiency and First Nation involvement.

Video: Power line construction

Data Privacy Statement

Data Privacy Statement